Accounting for

foreigners in Brazil Brazilians abroad natural persons legal entities

The help you need to have peace of mind with your tax and tax issues.

Why do you need an accountant?

We know that this tax part is difficult, challenging and somewhat “boring” for most people who do not have the knowledge about it.

The absence of an accountant can cause a series of problems and extra costs that would have been avoided if they were done by a specialized professional.

Problems that you will avoid :

- Payment of fines and penalties for negligence

- Double Taxation

- Loss of Individual Taxpayer Registration (CPF)

- Difficulty opening bank accounts

- Legal problems and restrictions on public services

- Lawsuits and tax evasion problems

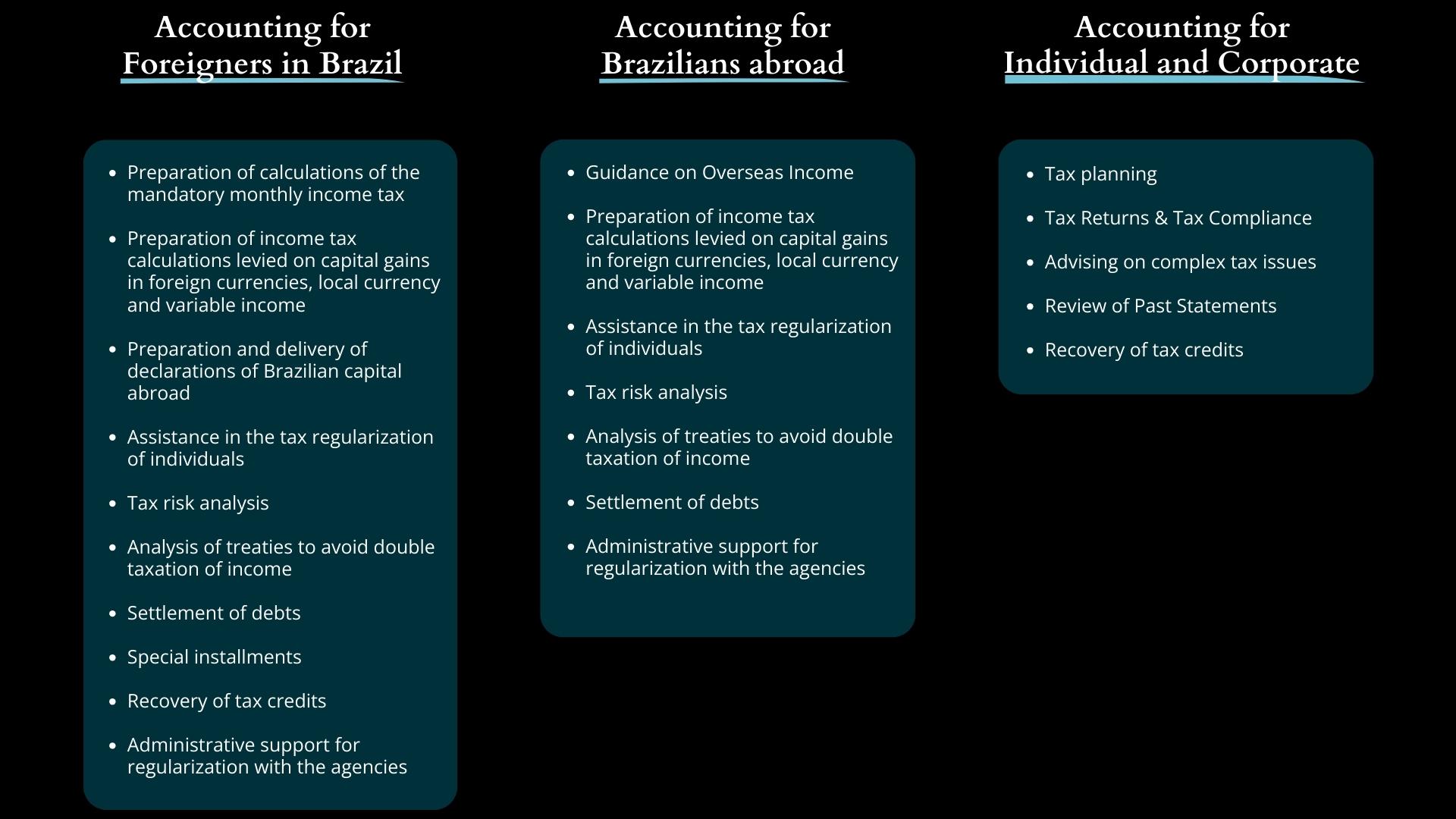

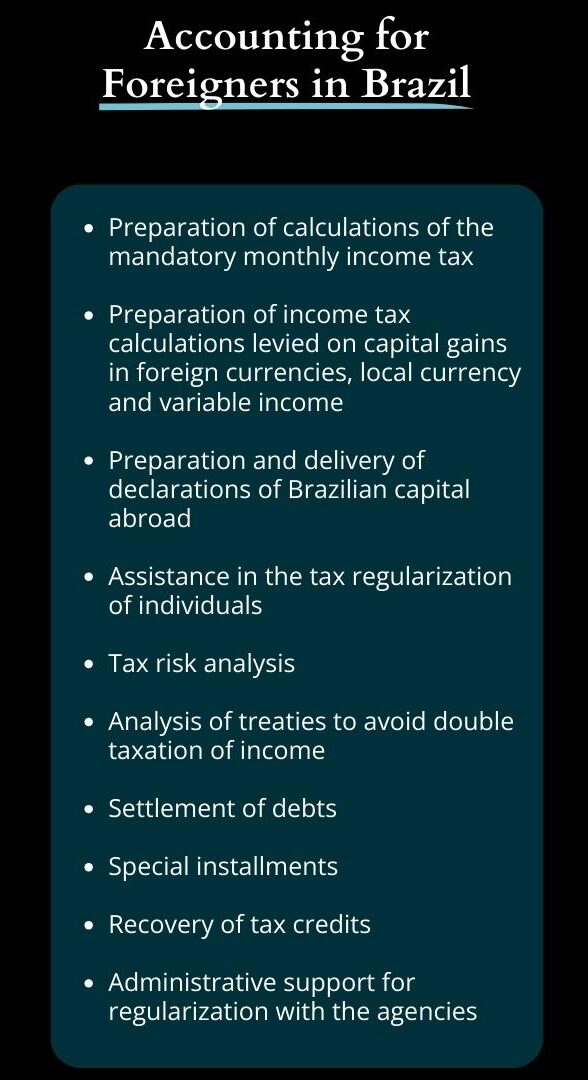

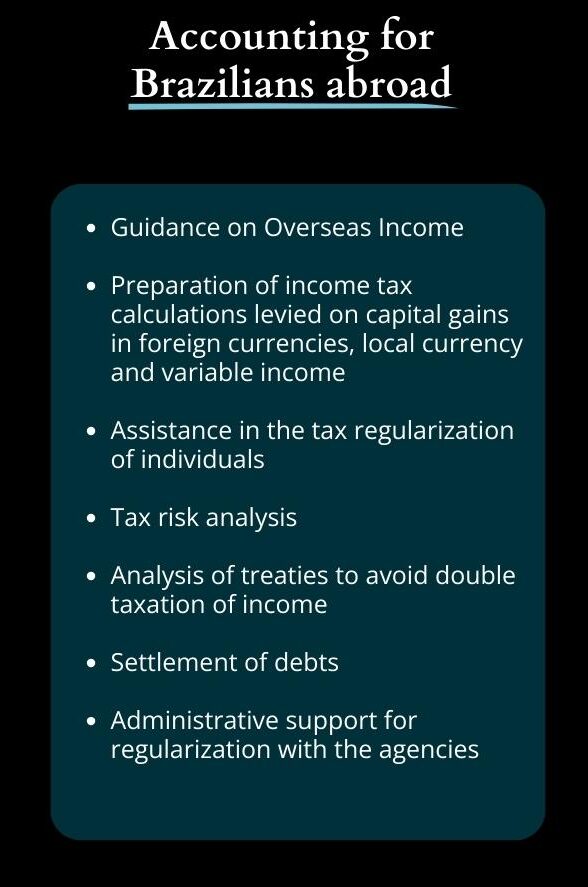

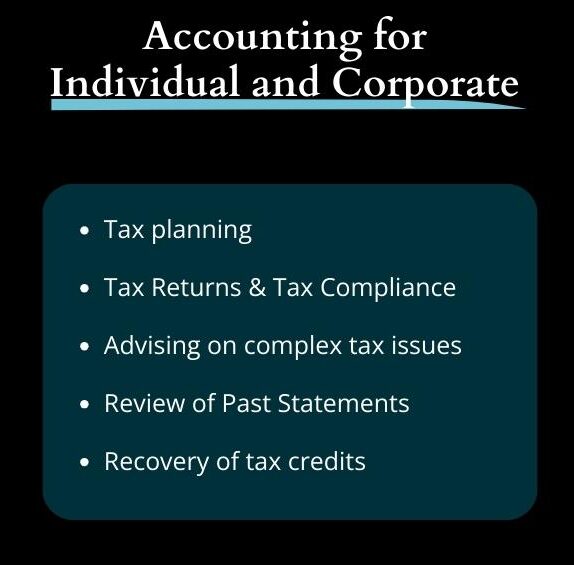

What I do:

Meet your accountant:

Laecio is an Accountant (CRC-BA 024.554/O-2) specialist in Income Tax for Foreigners and Expatriates, having served people from the United States, England, Italy and other countries .

With more than 20 years of experience in the accounting, tax and financial areas, he has worked in some American and Canadian multinationals over the years.

Its mission is to ensure the peace of mind of its customers so that they do not need to worry about any bureaucratic tax issues, delivering an efficient and hassle-free service.

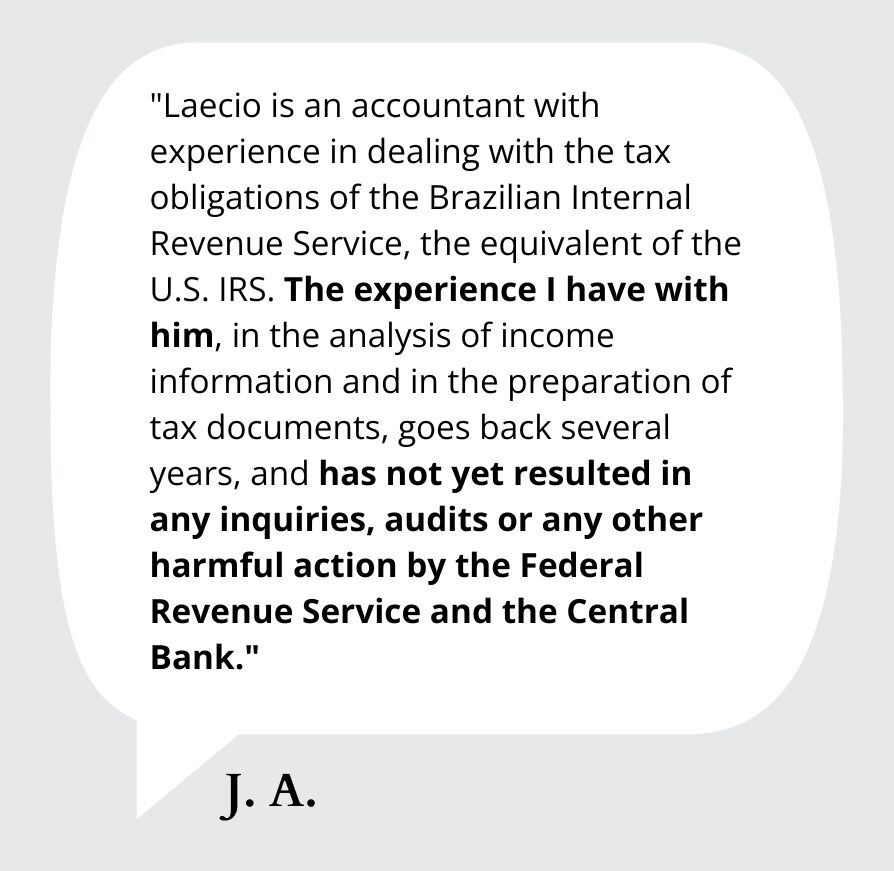

See what they say about our services:

FAQ

As a foreigner residing in Brazil, you must comply with the following tax obligations:

– Declare your income, both in Brazil and abroad, to the Brazilian Federal Revenue Service.

– Pay taxes due on your income in Brazil.

– Comply with ancillary obligations, such as issuing an invoice, if applicable.

– Stay up to date with tax laws and regulations in Brazil to avoid problems with tax authorities. It is recommended to seek guidance from a professional specialized in tax matters.

Yes, as a resident of Brazil, you must declare your income obtained both in Brazil and abroad to the Brazilian Federal Revenue Service. This includes salaries, rents, investments, among others. It is important to comply with this tax obligation to avoid future problems.

Income obtained abroad must be declared in the “Income Received from Individuals and Abroad” form of the Income Tax declaration, informing the country of origin, the amount received and the tax paid (if any).

The deadlines for declaring Income Tax in Brazil may vary each year, but are generally between March and April. It is important to pay attention to announcements from the Federal Revenue Service to know the exact dates and comply with obligations within the established deadline.

Yes, Brazil has double taxation agreements with several countries, which can benefit foreigners who receive income both in Brazil and in their countries of origin. These agreements aim to avoid double taxation and may include benefits such as reduced withholding taxes or tax exemptions in certain cases. It is important to consult a tax expert to understand how these agreements may affect your personal or business situation.

Some examples of expenses that can be deducted on the income tax return in Brazil include expenses with education, health, alimony, dependents, private pension and contributions to certain funds. However, it is important to consult updated legislation and specific IRS rules to find out which expenses are eligible for deduction and what limits are established.

Bank accounts abroad must be declared in the Annual Personal Income Tax Declaration (DIRPF) in the “Assets and Rights” form under code 62 – Bank deposit in current account abroad. It is important to inform the country where the account is located, the name of the bank, the account number and the balance on December 31st of the previous year. Furthermore, if there is income earned in the account, it must be declared in the form “Taxable Income Received from Individuals and Abroad.

– Fines and interest on the amount owed.

– Restrictions on public services, such as issuing a passport and renewing a driver’s license.

– Protests at a notary’s office and inclusion of the debtor’s name in defaulter records.

– Legal actions to collect the amounts owed.

– Possibility of responding to criminal proceedings for tax evasion.

It is important to comply with tax obligations correctly to avoid future problems with the tax authorities.

Although it is not mandatory, it is highly recommended to have the assistance of an accountant specialized in tax matters in Brazil. An accountant can provide personalized guidance based on your specific situation, ensuring you correctly meet your tax obligations and take advantage of available tax benefits. They can help you avoid mistakes and optimize your tax situation.